Trusted App Developer for AEPS and Fintech Applications

Brilliace Innovation is a large app development company in India, which offers powerful AEPS app development services for start -up, dealers, financial institutions and service providers. As a reliable app developer, we specialize in creating secure, scalable and user -friendly digital payment platforms using the base -based technology. Our APS application allows users to perform bank transactions using the Aadhaar number and biometric authentication for convenience, security and access in rural areas.

Our team of expert developers offers end-to-end customized app development solutions, including APS API integration, biometric support and administration panel. We develop mobile applications and web applications that help you increase your digital payment business faster. Whether you want to launch a dealer AEPS service, offer B2B Fintech solutions or expand with UPI integration, we have covered you.

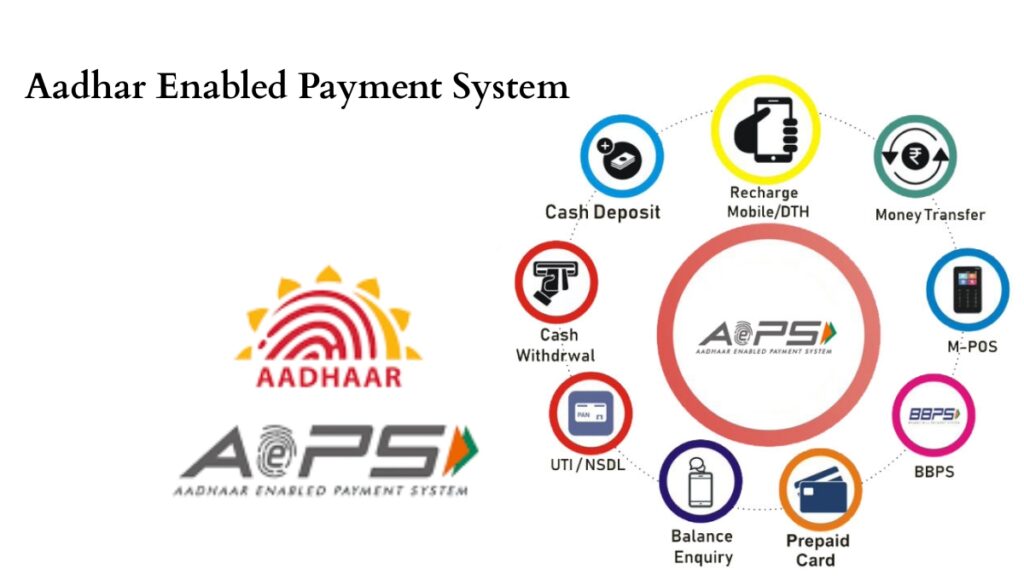

What is AEPS (Aadhaar Enabled Payment System)?

APS (Aadhaar activated payment system) is a secure payment method developed by NPCI (National Payment Corporation of India) that allows customers to carry out basic bank transactions using Aadhaar approval. Only by using the Aadhaar number and fingerprint, users can do:

Withdraw cash

Check account balance

Get mini statements

Transfer funds

Pay merchants via Aadhaar Pay

It is a revolutionary digital banking model that promotes financial inclusion in semi-urban and rural areas. We help businesses build AEPS systems that connect directly with banking APIs and UIDAI services, providing fast and secure transactions for end users.

AEPS App Development Services We Offer

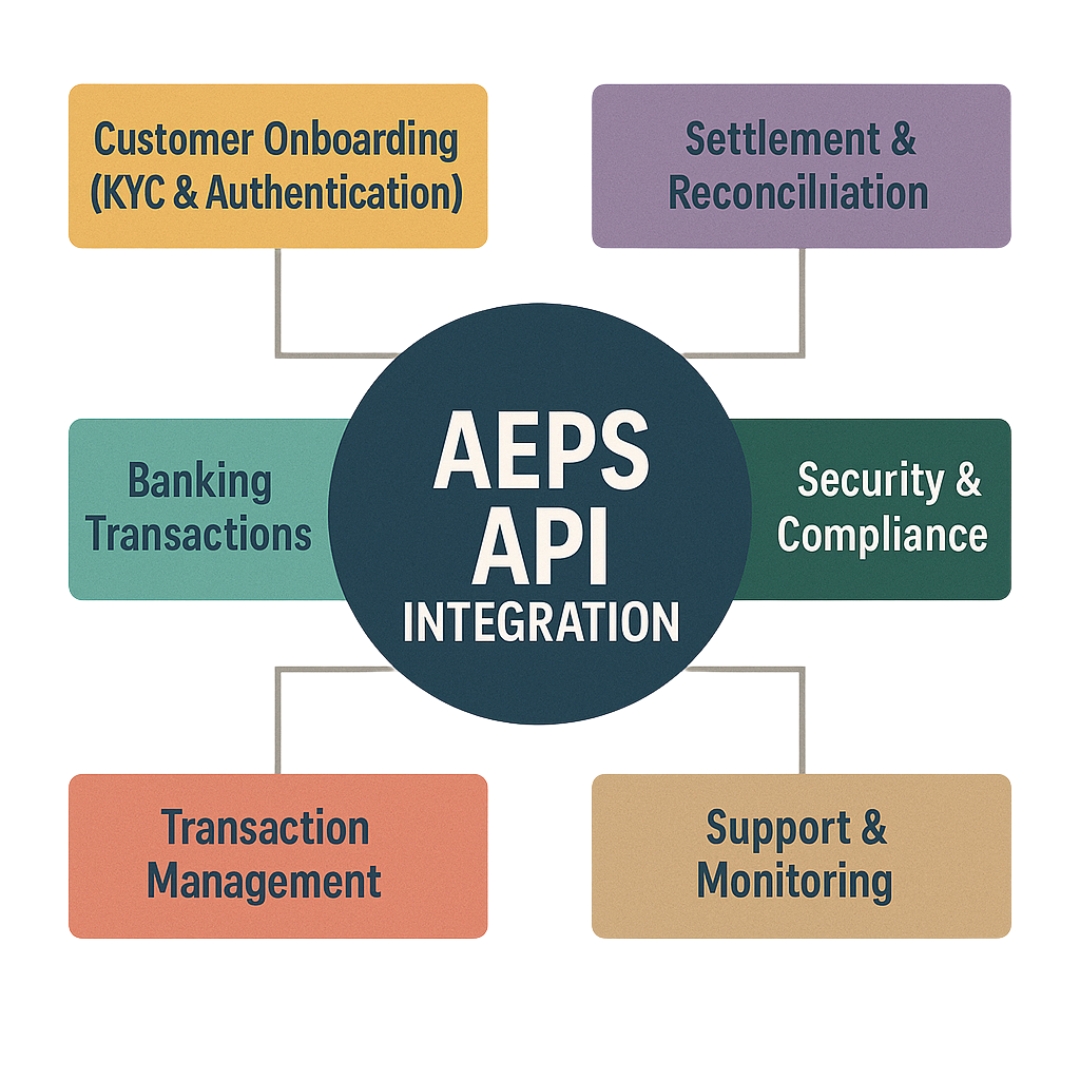

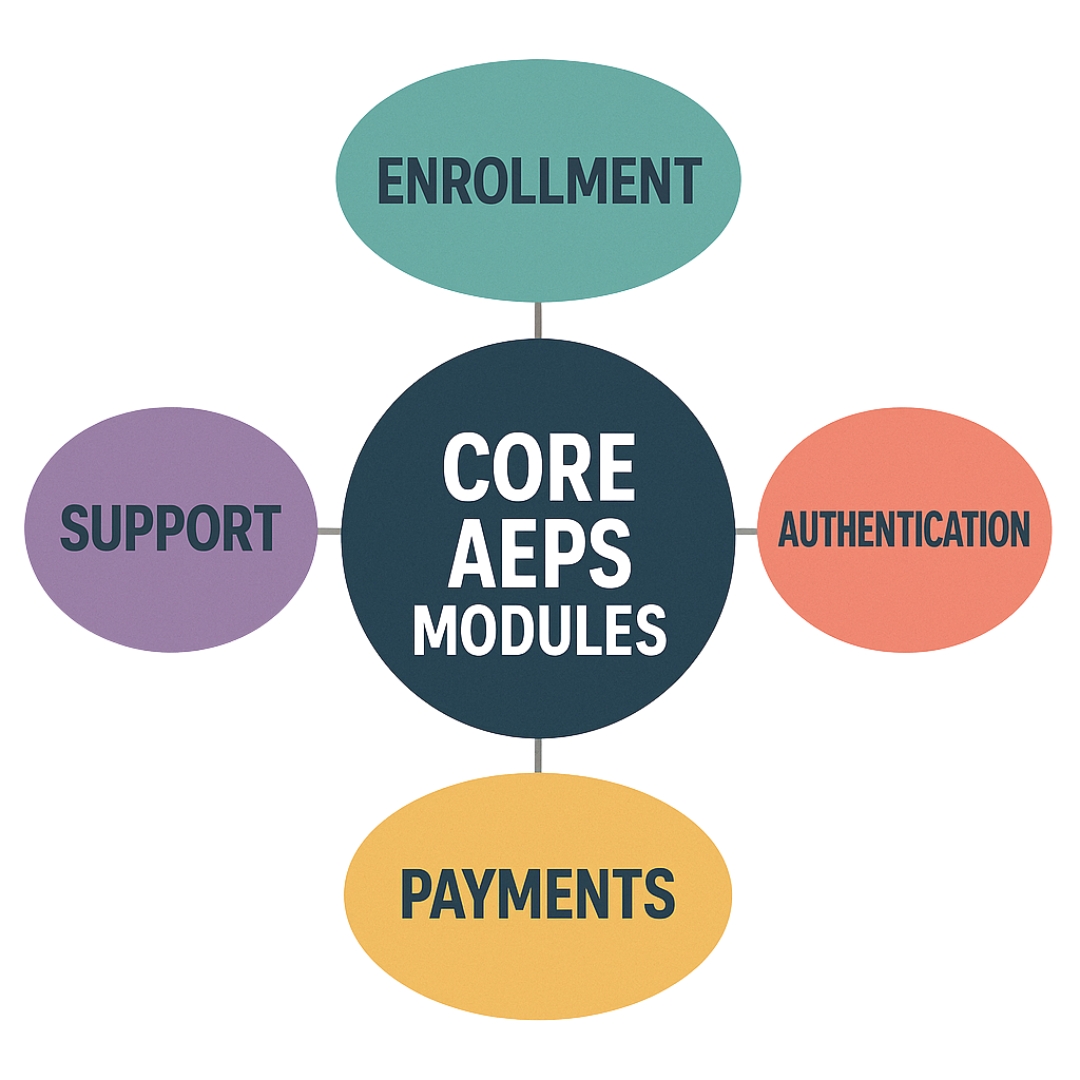

In Brilliace Innovation, we offer a fully adapted APS solution that includes all necessary features to launch and run the Fintech business. Our APS apps come with a rich set of tools, dashboards and module as:

How Does the AEPS API Work?

Aadhaar & Biometric Data Submission

The AEPS process starts when a user enters their Aadhaar number and selects a service like cash withdrawal or balance inquiry. They then authenticate using a fingerprint scanner connected to the system. This biometric data is encrypted and submitted via the RD (Registered Device) service.

API Request Sent to Bank/NPCI

The AEPS app sends this encrypted request to the linked bank through the AEPS API, which further communicates with NPCI (National Payments Corporation of India). The API verifies the Aadhaar number, checks the fingerprint match, and processes the requested service securely.

Transaction Response & Settlement

Once verified, the API returns a success or failure response to the AEPS app. If successful, the transaction amount is settled instantly to the user or merchant wallet, and a receipt or message is generated confirming the transaction — all in real time.

Users can easily withdraw cash from their Aadhaar-linked bank accounts by authenticating with their fingerprint — no need for debit cards or ATM access.